| Home Our Team The Market Products Links Contacts | Spanish | English |

|

We provide an agile, efficient and personalized service in the placing and assessment of reinsurance risks worldwide.

Thanks to the experience and international support we have, today we can offer an extensive Reinsurance portfolio which allows us to accommodate all the needs of Bolivian market in respect of local operations as well as the expansion of activities in the regional and international scope.

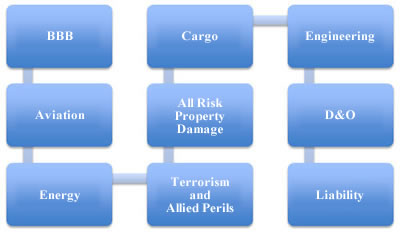

We have developed an interesting business portfolio, covering every area of the reinsurance field.

1.- BANKERS BLANKET BOND POLICY (BBB)

Directed to the protection of financial entities against patrimonial damages such as:

- Employees Infidelity.

- Loss of Money and/or values incurred by diverse causes in the Insured’s premises.

- Loss of Money and/or values incurred during the transportation and transfer of same.

- Losses by consequence of document forging

- Losses for reception of false currency.

- Losses for electronic and computer crime.

- We also give cover to specific requirements according to the financial entity.

2.- AVIATION POLICY

Directed to cover aircraft owners against any loss or damage to own aircraft, leased aircraft or an aircraft under the control or custody of the air-operator, as well as the liability to third parties, passengers, crew, search and rescue, cargo and luggage resulting from their operations.

3.- ALL RISK PROPERTY DAMAGES

Directed to cover losses, raw material, processed and finished products and other assets, which could be subject to accidental losses and/or damages.

The main insured risks are:

- All Risk Property Damages

- Fire, ray, explosion

- Nature hazards

- Political risks

- Thefts

- Explosions

- Breakdown

4.- ENGINEERING RISKS

Direct to cover the needs of the oil industry, from exploration, exploitation and hydrocarbon production, the transportation of same, as well as their refining, trading and storage.

Covers the assets needed for the production of oil as well as derivative products, workers and third party responsibilities which can be derivative from the petrol industry.

5.- LIABILITY

Directed to protect the insured against a possible economical loss as a consequence of demands received for having caused damage to third parties’ assets by negligent actions.

There are specialized covers for different kinds of people and companies such as:

- Extracontractual Liability

- Companies Liability

- Employers’ Liability

- Operational Liability

- Products Liability

- Family Liability

- Cargo Liability

- Parking Lot Liability

6.- CARGO

Directed to cover losses and/or damages that the insured’s goods might suffer as a consequence of fortuitous accidents or unexpected events affecting the transportation means being air, land or maritime.

The cover given by this insurance begins in the place of origin designated in the Policy, from the moment at which the assured goods are stowed or prepared in the boat or in the vehicle that will transport them. It continues during the ordinary course of the transportation and finishes when being unloaded in the place of destination but taking no more than twenty-four hours after the arrival to destination of transporting means, if the unloading had not taken place.

7. - DIRECTORS AND OFFICERS (D&O)

Members of the Board of Directors and Officers have the responsibility to direct and ensure that the purpose of the non-profit organizations is complied with.

They have a fiducidiary responsibility to act and take decisions according to the entity’s best interest and safeguard the organizations’ assets.

This Policy protects the estate of the directors of the companies for possible liabilities that can affect them according to their legal liabilities summarized in Law 222 of 1995.

8. - TERRORISM AND ALLIED PERILS

Terrorism coverage protects destruction and material damages caused by terrorist acts, including those that are carried out by people who belong to subversive movements.

It also includes strikes, which is the collective temporary and peaceful interruption of work, carried out by the staff of a company with lucrative or professional ends.

Protest demonstration, Riot or Civil Commotion: the intervention of people in disorders, alterations and disturbances, riots, acts of violence and commotion with the purpose of demanding from the authority the execution or omission of actions attributed to their own functions.

Wrongful acts of third parties, including terrorist acts and terrorism: material damages that the assured goods may suffer caused by wrongful acts of third parties, including the explosion originated in such acts.

Also, it protects destruction and material damages arisen from terrorist acts, including those that may be carried out by people who belong to subversive movements.

9. - ENERGY RISKS

It covers machinery and equipment damages of a company caused by some accidental and unexpected event, sudden and unforeseen. Additionally, it is possible to offer Liability and Loss of Benefit covers.

Electronic Equipment.-

It covers any type of damages that electronic equipment or parts of the same can have from any accidental damage, sudden and unforeseen that the assured’s equipment may suffer, even the expenses caused by renting or hiring of additional equipment as well as compensation of tapes, floppy disks, optical disks or other data storage devices.

It is possible to include communication equipment, electronic equipment or any other equipment that has electronic parts, according to the requirement.

Construction All Risk (CAR).-

It covers material damages occurred during the carrying-out of any construction work caused by accidents due to natural phenomenon, accidental facts or defective material, geological dangers, damages to own equipment and machinery or those who belong to subcontractors, as well as the third party liability.

Erection All Risk (EAR).-

It covers unpredictable and accidental material damages occurred during the erection of some equipment, test and the start up of the same, as a consequence of natural phenomenon, accidental damages, as well as the liability, damages to third parties.

All Risk Contractor Equipment.-

It covers accidental damages to mobile or heavy equipments as well as the damages to goods of third parties and damages to third parties.

HOW DO WE DO IT?

Within our objectives we underline the analysis, identification, evaluation and risks placements, for which we work with expert Reinsurers of ample, well-known experience, with proven strength and trustworthiness. This allows us to guarantee financial security of the companies and the payment of claims which is the final objective of the reinsurance contracts.

We carry out a continuous control about reinsurance markets all over the world as well as the risks analysis and risks examination.

Each and every risk will be considered by its own merits without applying discriminatory policies, and always applying professional standards which are our characteristic that have allowed us to became the leader company in the reinsurance national market.

WHY SHOULD YOU CHOOSE US?

- High level of specialization.

- Clear and direct negotiation.

- Personalised and appropiate assistance according to the reinsurance requirements.

- Non-application of minimum brokerage or premiums.

- Effective and immediate solutions.

- International support

|

Edificio Vitruvio 2, Oficina 4A |